Are Annuities Right for You? A Practical Guide to Income You Can Count On

A practical guide to the advantages and disadvantages of an annuity.

INDIVIDUAL

Dustin Dellera

4/3/20252 min read

💸 Let’s Talk About Income That Doesn’t Fluctuate

When you’re planning for retirement, it’s not just about how much you’ve saved—it’s about how reliable that money is when you actually need it.

That’s where annuities come in.

They’re often misunderstood, but when used right, they can provide guaranteed income for life, protect your principal, and reduce stress in retirement.

Let’s break down the types—and when they make the most sense.

🔒 Fixed Annuities

What they do:

Provide a guaranteed interest rate for a set period of time (think CD alternative with insurance backing).

Best for:

People close to retirement

Risk-averse investors

Safe money with modest growth

Why it works:

You know exactly what you’ll earn—no market swings, no guessing.

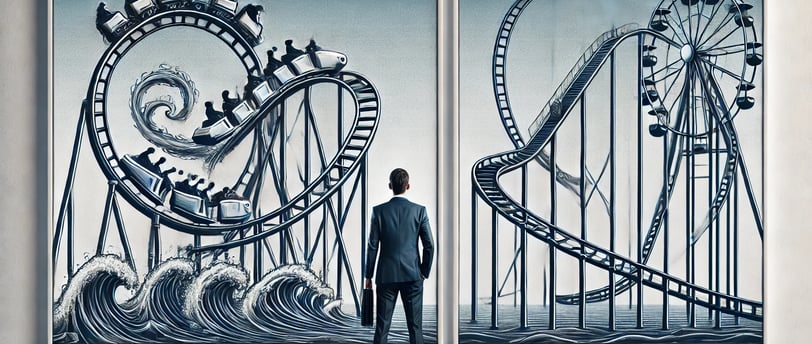

📈 Fixed Indexed Annuities (FIAs)

What they do:

Tied to a stock market index (like the S&P 500), but with no downside risk. It wont have the same peaks, but it eliminates the dips.

Best for:

People wanting better growth than a CD

Folks who want to avoid losing money

Pre-retirees needing safe accumulation

Why it works:

You capture some upside, but your principal is protected if the market drops.

💰 Immediate Annuities

What they do:

You give the insurance company a lump sum, and they start sending you guaranteed payments—right away.

Best for:

Retirees needing instant, predictable income

People with a lump sum to convert into monthly cash

Anyone worried about outliving their savings

Why it works:

It’s like creating your own private pension that starts paying now.

⏳ Deferred Income Annuities

What they do:

Similar to immediate annuities, but the payments start at a future date (say 5–10 years down the road).

Best for:

Long-term planners

People in their 50s or early 60s preparing for retirement

Maximizing future income while reducing taxes now

Why it works:

You lock in income for later—and the longer you defer, the higher the payment.

🔄 Real Use Case: Optimizing Private Pension Dollars

We recently worked with a client who had a private pension. It was okay—but it wasn’t flexible, and the survivor benefits were limited.

So we helped him:

Reallocate a portion of those funds into a fixed indexed annuity

Guarantee lifetime income for him and his spouse

Unlock more control over how and when they used their retirement money

End result? More income, less stress, and total flexibility if things changed down the line.

⚙️ Want to See How This Could Work for You?

Whether you're 10 years out from retirement or already sitting on a pension, annuities can help you turn your savings into income—without betting it all on the stock market.

👉 [Book a 15-Minute Call] to find out which type fits your strategy.

Or, Model different annuity structures on your own using the handy too below.

Comprehensive Insurance Solutions for Small Businesses and Individuals

© 2025. 6D Insurance Services, LLC. All rights reserved.

Mailing address:

9110 Alcosta Blvd. ste H-2004

San Ramon, CA 94583

CA License # 4253059